Malaysian property developer SPB Development Bhd has cleared a crucial regulatory hurdle, receiving Securities Commission approval for its Main Market listing on Bursa Malaysia. The IPO will introduce new investment opportunities while funding the company’s expansion across key growth regions in the country.

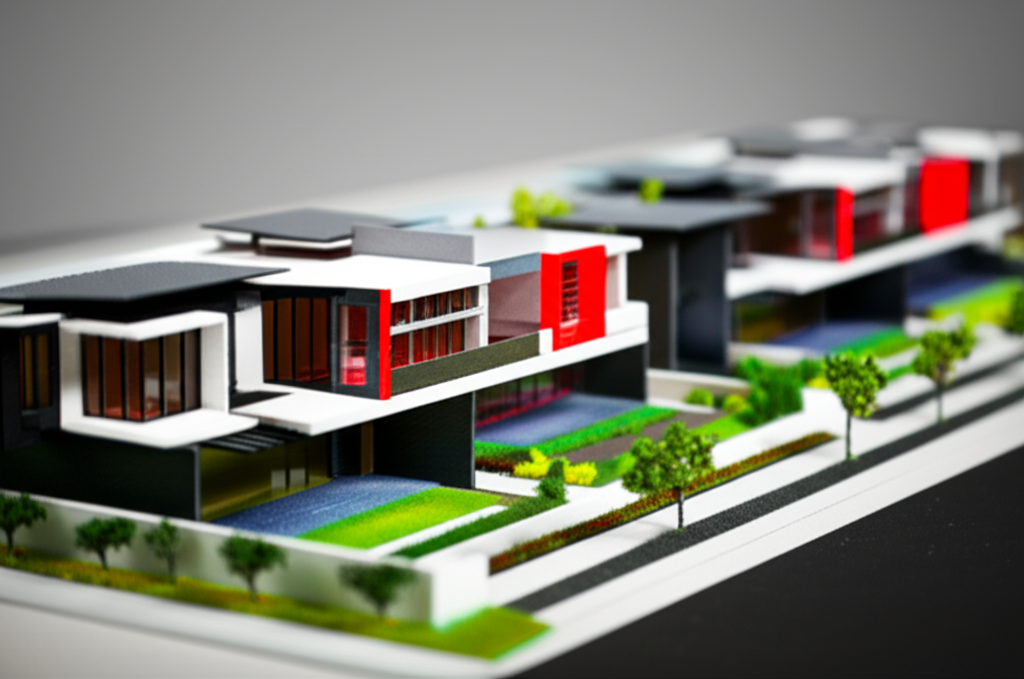

With three active projects in Melaka, Kedah, and Johor worth RM389 million, SPB Development has demonstrated strong market performance, achieving a 96% average take-up rate for completed properties. The company also holds 664 acres of undeveloped land nationwide, with plans to acquire an additional 187.4 acres in Johor Bahru through a strategic joint venture.

The IPO structure includes 191.1 million new shares and an 87.3 million share offer for sale, with allocations for both retail and institutional investors. CEO Datuk Jacky Yap emphasized the company’s focus on landed residential projects near industrial hubs, capitalizing on employment growth and rising demand. Proceeds will fund upcoming developments in Kedah and Selangor, alongside infrastructure investments in Penang.

Post-listing, the Yap family’s ownership will shift, with founder Datuk Yap Pit Kian retaining a 60% indirect stake through family holding companies. The leadership team remains family-driven, with key roles held by his children, including CFO Datuk Sean Yap and COO Yap Lih Shyan. Hong Leong Investment Bank and Sierac Corporate Advisers are overseeing the IPO process.