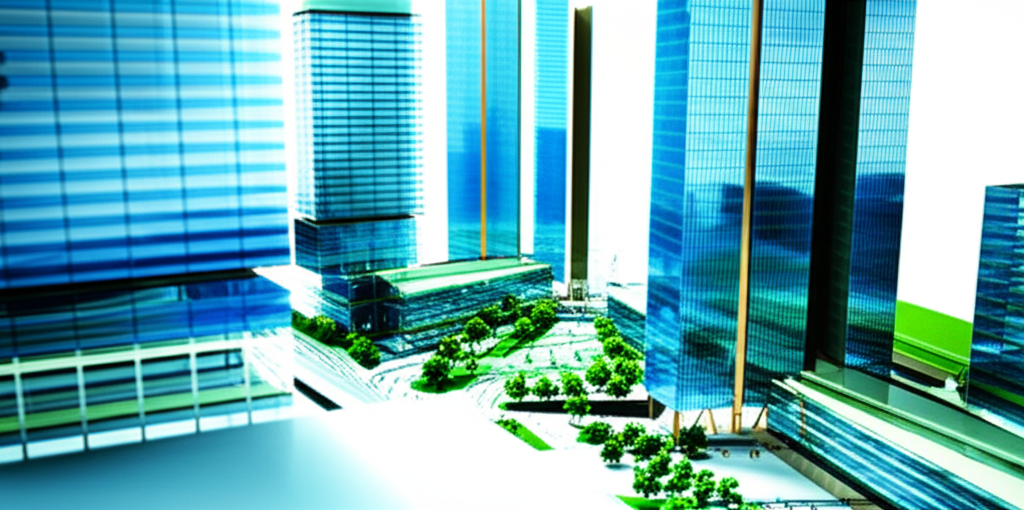

Malaysian conglomerate Jaya Tiasa Holdings is diversifying its business portfolio with a strategic RM100 million land acquisition in Sarawak’s Sibu district. The company’s property arm secured four leasehold plots near the town center, positioning itself for a major mixed-use development featuring residential, commercial, and healthcare facilities.

The transaction represents a value purchase, with the RM113 million-valued land acquired below market price. Three parcels already hold approvals for development, potentially accelerating project timelines. Jaya Tiasa plans to fund the RM469.6 million initiative through property sales, internal reserves, and potential financing arrangements.

This expansion into real estate marks a deliberate shift from the company’s traditional palm oil and timber operations. Management cites the need for more stable revenue streams less susceptible to commodity price fluctuations. The development timeline projects groundbreaking in 2026 with completion by 2031, contingent on market conditions.

Sarawak’s robust property market, accounting for over 70% of East Malaysia’s transaction volume in 2024, provides favorable conditions for the venture. The move follows Jaya Tiasa’s strong financial performance, with recent quarterly reports showing significant profit growth. This strategic pivot could redefine the company’s future earnings profile while contributing to regional urban development.