Australian real estate policies are creating waves that may reach Malaysian shores, as new restrictions on foreign buyers could reshape property market dynamics for developers operating across both countries. The recently announced two-year ban on overseas purchases of existing homes, set to begin in April 2025, aims to address housing affordability but may inadvertently redirect investment flows toward new developments instead.

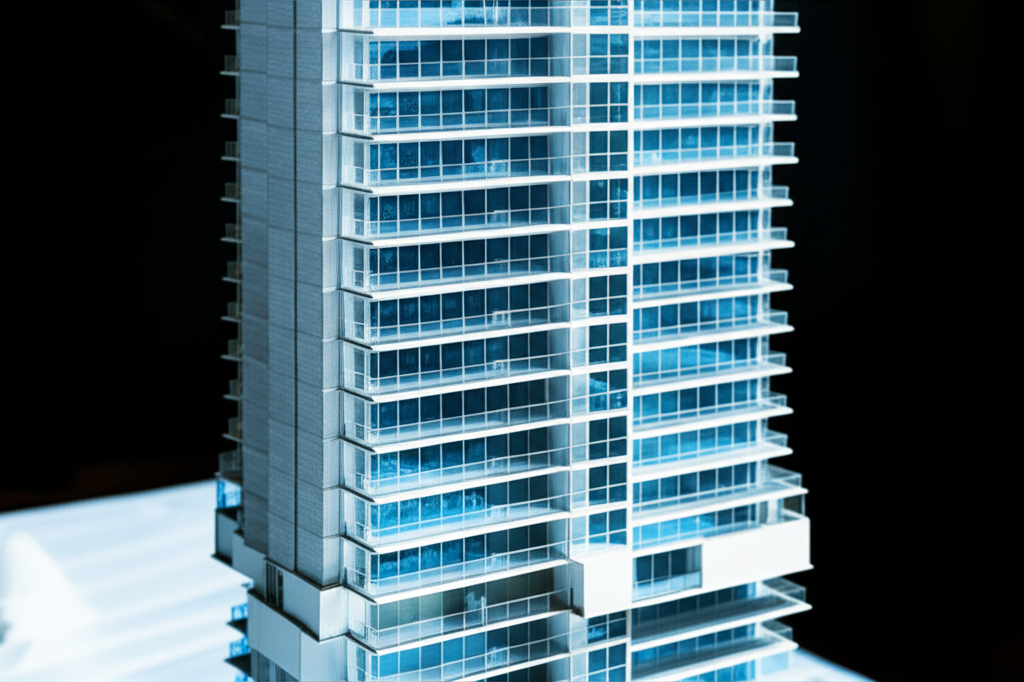

Several Malaysian property giants have significant stakes in Australian projects that could feel the policy’s impact. UEM Sunrise is working on Perth’s Subiaco Oval development worth RM1.4 billion, while SP Setia recently unveiled its RM2.8 billion Atlas Melbourne venture. Construction firms like MRCB and Gamuda also maintain active presences, with projects ranging from Gold Coast residences to St Kilda developments that may now face shifting demand patterns.

Market analysts suggest the immediate effects might be limited, as the restrictions specifically target secondary market transactions rather than new launches. CIMB Securities notes this could potentially channel foreign investment toward primary market offerings instead. However, the broader concern remains whether Australia’s already strained housing market – where just 10% of homes are affordable for median-income families – can sustain development momentum under these new constraints.

The policy emerges against a backdrop of cooling demand, with high interest rates and living costs already dampening Australia’s property sector. While intended as a temporary measure until 2027, its extension could hinge on whether it successfully stabilizes prices without stifling development. For Malaysian firms with Australian exposure, the coming years may require careful navigation of these shifting regulatory and economic currents.