GuocoLand Malaysia is reassessing its land assets as part of a strategic shift to unlock greater value, with potential expansion into industrial township development on the horizon. The property developer, part of the Hong Leong Group, disclosed these plans alongside its latest financial results, which revealed a 38.8% year-on-year decline in net profit for the third quarter ending March 2025.

The drop in profitability to RM1.8 million, down from RM2.94 million, was attributed to increased tax expenses and weaker contributions from hospitality and property investments. Revenue also saw a marginal dip to RM88.43 million, though the property development segment showed resilience. Notably, no dividend was declared for the quarter.

For the nine-month period ending March 2025, the group reported a 7.93% decline in net profit to RM11.98 million, with revenue falling 13.3% to RM284.29 million. The completion of Emerald 9’s first phase in the previous year contributed to the downturn, though improved hospitality occupancy rates and stronger rental income from DC Mall provided some balance. Lower financing costs also helped cushion the impact.

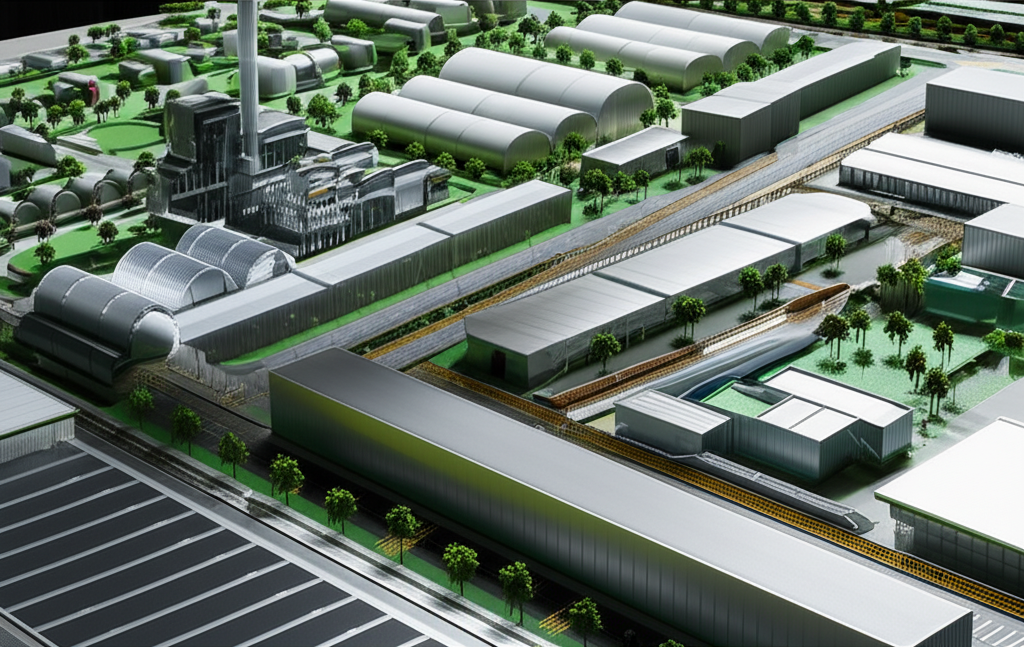

Moving forward, GuocoLand plans to focus on disciplined financial management and timely project completions while tailoring new launches to market demand. The company aims to optimize its land bank and explore industrial developments as part of its long-term growth strategy.