China’s growing global influence has sparked debates about its economic engagement strategies worldwide. While some view China as imposing its development model, a closer look reveals a more nuanced approach—one that adapts to local contexts while pursuing strategic objectives. This dynamic is particularly evident in Malaysia’s Iskandar development zone, where Chinese investment has reshaped economic and political landscapes in unexpected ways.

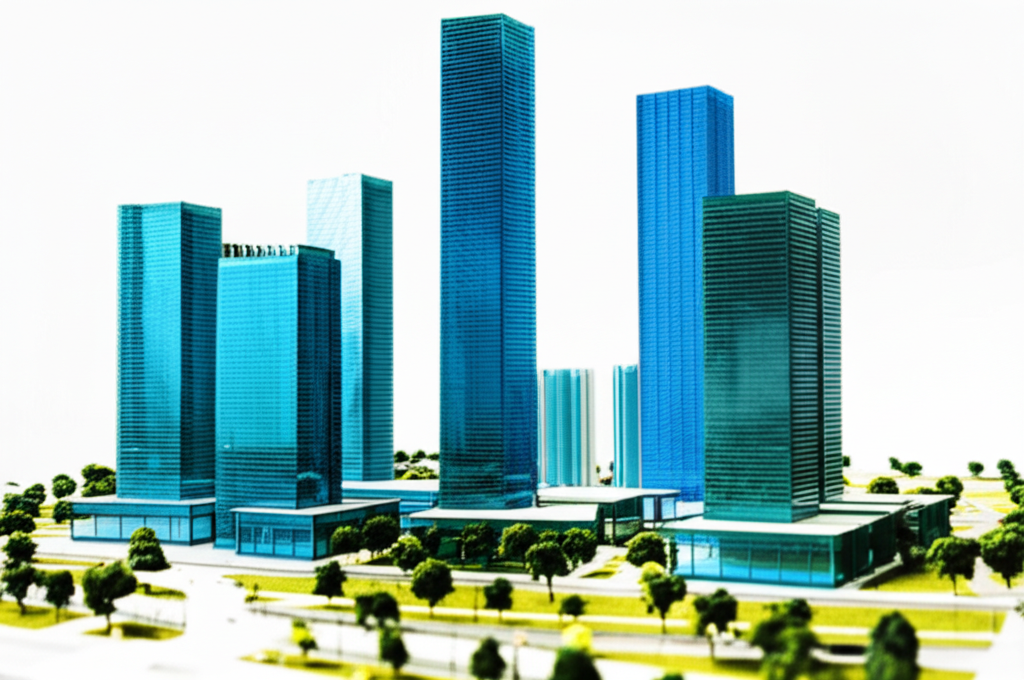

The Iskandar Malaysia economic corridor, located in Johor state, became a magnet for Chinese real estate firms following the 2013 launch of China’s Belt and Road Initiative (BRI). Projects like Forest City and Princess Cove promised economic growth but also triggered political tensions. Johor’s state government saw Chinese investment as a counterbalance to federal dominance, while opposition figures weaponized public discontent over unaffordable housing. The backlash contributed to the 2018 electoral defeat of Malaysia’s long-ruling UMNO party, demonstrating how foreign capital can disrupt domestic power structures.

Chinese developers initially underestimated Malaysia’s complex political dynamics. Country Garden, Forest City’s developer, faced criticism for catering to wealthy foreign buyers while locals struggled with housing shortages. When Beijing imposed capital controls in 2017, restricting overseas property investments, Chinese firms were forced to recalibrate. Despite corporate social responsibility efforts—such as school donations and environmental initiatives—the disconnect between high-end developments and local needs fueled resentment. The episode highlights how Chinese firms must navigate not just economic risks but also political sensitivities in host countries.

The Iskandar case offers broader lessons for China’s global investments. Rather than imposing a rigid model, Chinese firms increasingly adapt to local conditions—yet political risks remain. Malaysia’s experience shows that foreign capital can empower regional actors, but without equitable benefits, projects risk becoming flashpoints. As China’s real estate sector faces domestic turbulence, overseas ventures like Forest City may shift from grand ambitions to pragmatic survival. The interplay of global finance and local politics continues to redefine China’s role in the world—one investment at a time.